Green Energy Minerals: Strategic Opportunities in Central Asia, the Caucasus, and Ukraine

Recent Articles

Author: Joshua Bernard-Pearl

09/05/2024

This is the second installment in the Caspian Policy Center’s Strategic Minerals series, exploring what materials are needed for green energy and how Central Asia, the Caucasus, and Ukraine could become key players in the quest for a green future.

As the world accelerates toward a greener future, the demand for clean energy technologies is soaring. Solar panels, wind turbines, and advanced batteries are at the forefront of this transition, promising a sustainable and environmentally friendly energy landscape. However, the realization of this green future hinges not only on technological innovation but also on securing a steady supply of strategic minerals essential for these technologies.

So-called “critical minerals,” ranging from aluminum and cobalt to rare earth elements like neodymium and dysprosium, are fundamental to the efficiency and functionality of renewable energy technologies. Yet, the global supply chain for strategic minerals is under strain. Skyrocketing demand and a heavy reliance on China are creating vulnerabilities and prompting a search for alternative sources.

In response to supply risks and geopolitical tensions, new frontiers are emerging as potential sources of critical minerals. Central Asia, the Caucasus, and Ukraine stand out as regions with vast, untapped reserves and underdeveloped potential that could play a pivotal role in diversifying the global supply chain.

Various U.S. government agencies have defined different minerals and materials as strategic or critical. The list most relevant to green technology, however, is the Department of Energy (DOE)’s “Critical Materials for Energy List,” containing 18 materials sometimes referred to as the “electric 18.” Within this list of 18 materials, there are 16 minerals: aluminum, cobalt, copper, dysprosium, fluorine, gallium, iridium, lithium, magnesium, natural graphite, neodymium, nickel, platinum, praseodymium, silicon, and terbium. The two remaining materials are electrical steel and silicon carbide.

Source: Wikimedia

Source: Wikimedia

Focusing on the 16 minerals critical for the future of green energy, it is worth noting that four of those minerals (terbium, dysprosium, praseodymium, and neodymium) are often referred to under the broader category of Rare Earth Elements (REE). REEs have similar electron structures and unusual electrical and other properties that make them valuable for a variety of industrial applications.

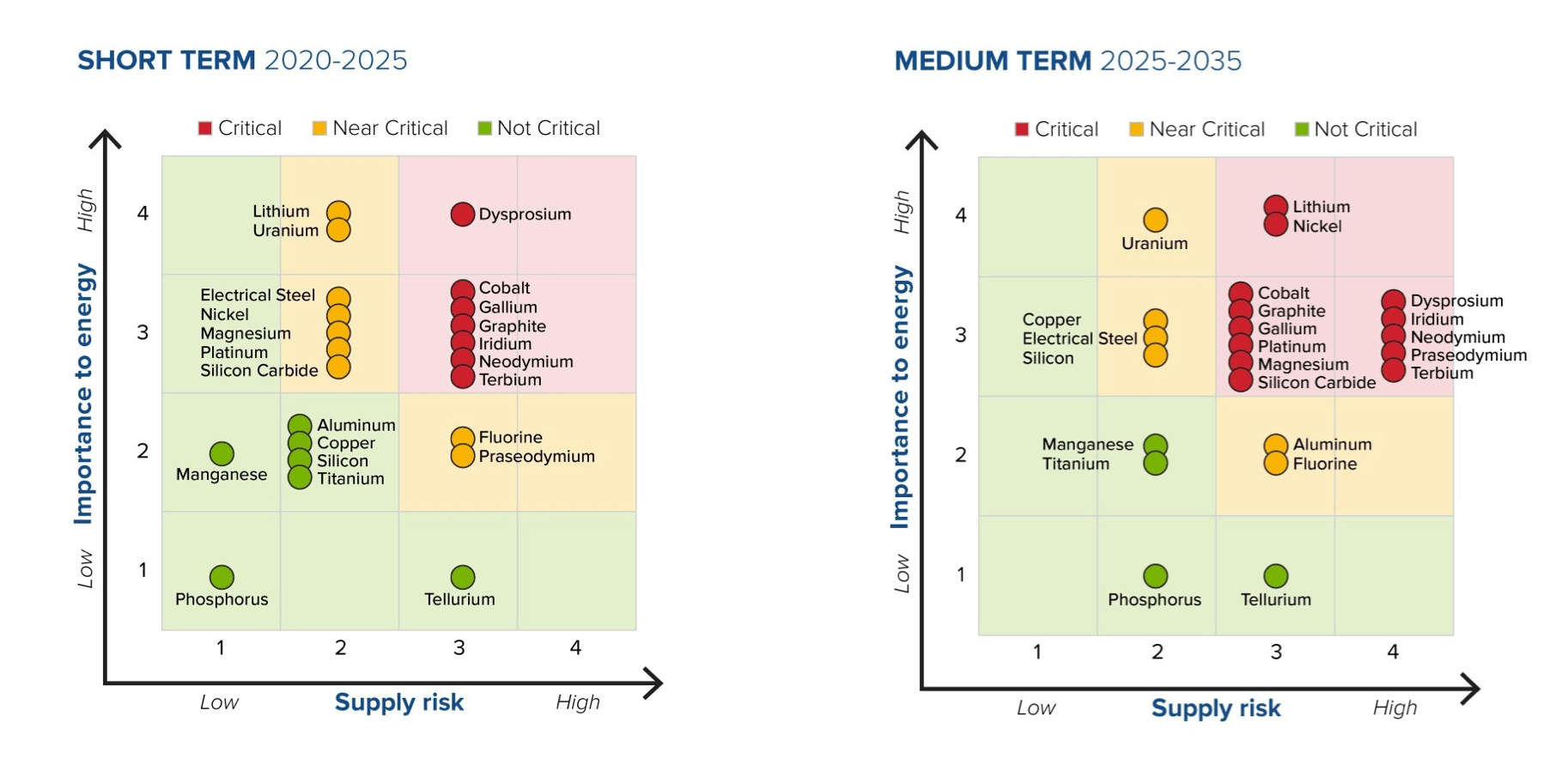

These critical minerals for energy minerals were designated as “critical” due to a combination of their importance to energy technologies and a high supply risk in the future. Their importance to energy comes from their use in key green energy technologies while much of the supply risks come from an overreliance on China.

Figure 1: DOE Criticality of Minerals Graphed

Source: U.S. Department of Energy

Source: U.S. Department of Energy

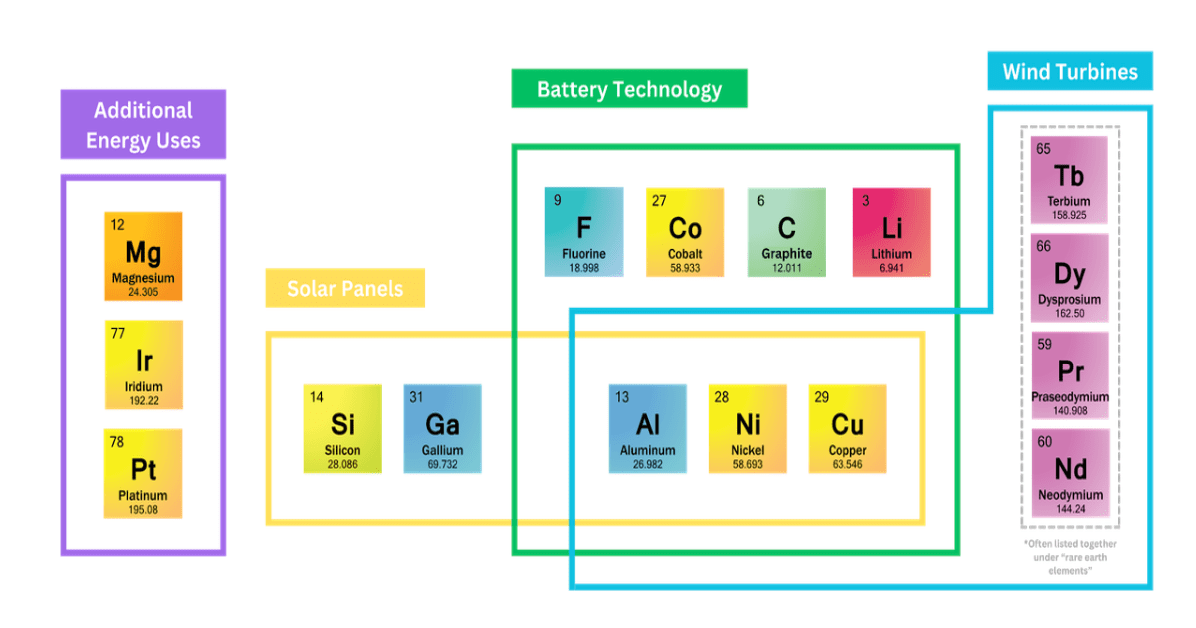

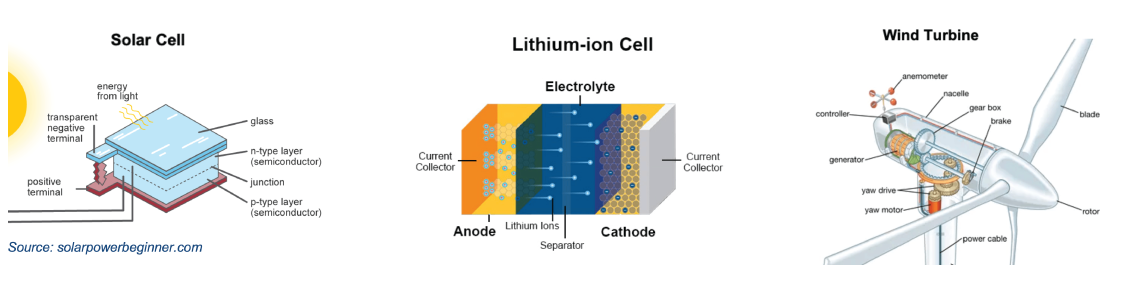

Three green energy technologies often dominate the discussion: photovoltaic cells to capture solar energy, wind turbines to harness wind energy, and battery technology to store that energy for use regardless of whether the sun is shining or the wind is blowing. Aluminum, nickel, and copper are critical to all three of these technologies. Aluminum and nickel are part of the alloys used to make structural elements such as wind turbine blades, wind turbine towers, battery casings, and solar panel frames.

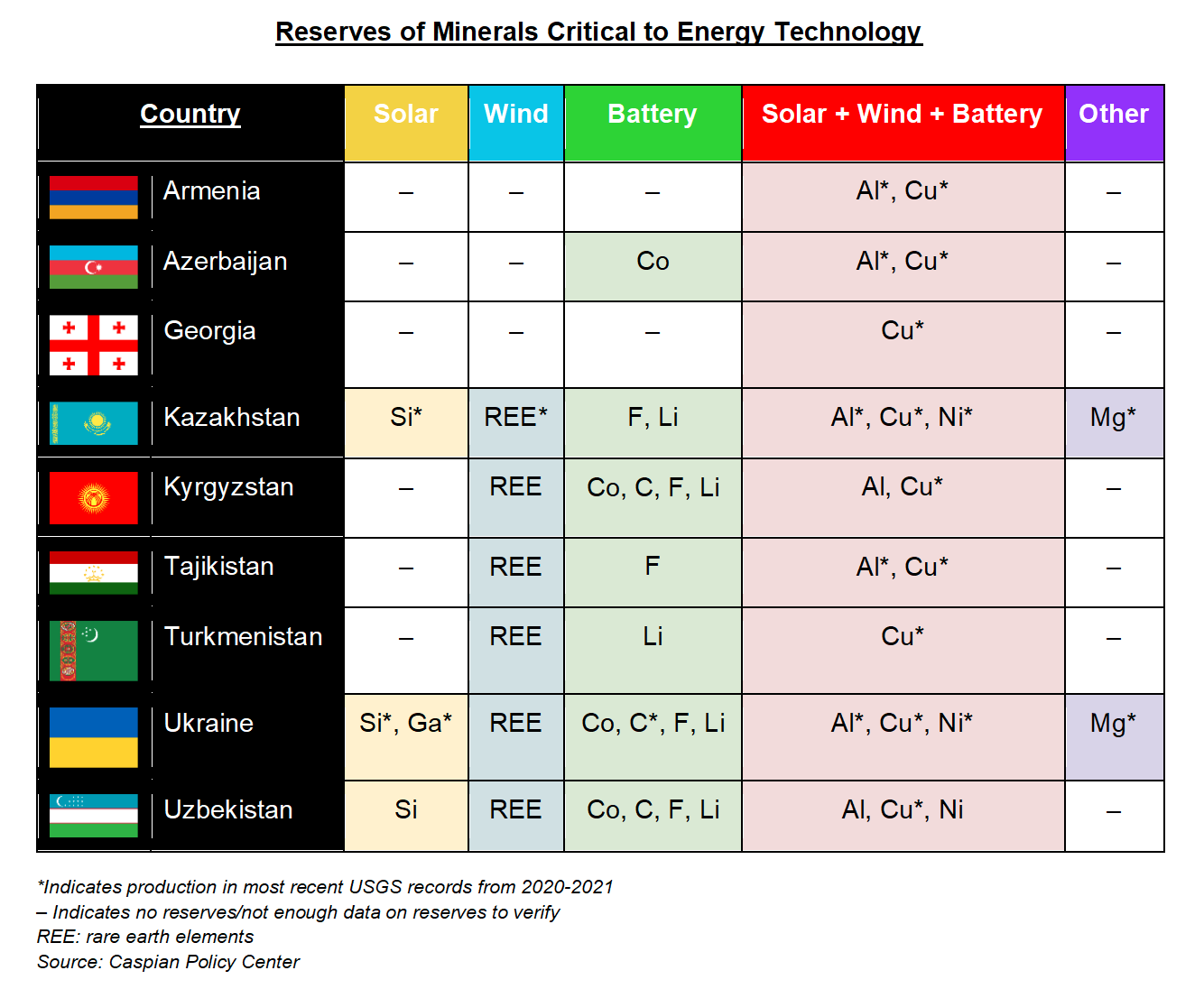

Aluminum notably makes up over 85% of the components in solar panels. Copper, prized for its electrical conductivity, is used in many of the internal components such as internal wiring, current collectors in batteries, wind turbine generators, and the heat exchanger in solar panels. All three of these minerals are abundant across Central Asia, the Caucasus, and Ukraine. Kazakhstan is especially noteworthy as the 11th largest copper producer in the world.

Figure 2: Uses of Minerals Critical to Green Energy

Lithium-ion batteries are the most widely used type for energy storage and electric vehicles. In these batteries, the anode is typically made up of graphite coated in a copper current collector, while the critical materials for energy most commonly used in the cathode are lithium, cobalt, and nickel oxides coated in an aluminum current collector. Ukraine is a noteworthy source of graphite, with 20% of global reserves. The country likewise contains significant yet untapped reserves of lithium, designated by the DOE as the mineral most important to energy in the short and medium term.

Lithium-ion batteries are the most widely used type for energy storage and electric vehicles. In these batteries, the anode is typically made up of graphite coated in a copper current collector, while the critical materials for energy most commonly used in the cathode are lithium, cobalt, and nickel oxides coated in an aluminum current collector. Ukraine is a noteworthy source of graphite, with 20% of global reserves. The country likewise contains significant yet untapped reserves of lithium, designated by the DOE as the mineral most important to energy in the short and medium term.

Uzbekistan, Kazakhstan, and Azerbaijan also contain reserves of minerals critical to battery production, though these minerals have yet to be extracted in any significant quantity. Without batteries, any expansion of renewable energy generation will be nullified. Long-lasting and energy-efficient batteries are a necessary component for electric vehicles and grid capacity. Untapped resources in Ukraine, Uzbekistan, Kazakhstan, and Azerbaijan could be the key to making sure a green future is attainable and affordable.

REEs neodymium, praseodymium, dysprosium, and terbium are critical to manufacture powerful permanent magnets used in wind turbine generators. Uzbekistan, Kyrgyzstan, Kazakhstan, and Ukraine have significant deposits of REEs, with other countries in the broader region possessing varying degrees of abundance. Growing demand and concern over Chinese dominance in the rare earth sector have sparked renewed investment in REE extraction in the region, including an Uzbek-Korean partnership in 2019 to create the first center for the study of REE in the region. Due to the high cost of extraction and processing technologies for REE, foreign investment is crucial to develop a supply of minerals in the Caspian Region that is not dependent on neighboring China and which can fuel wind turbine construction in the West and across the globe.

Building the infrastructure for solar farms requires two additional minerals designated as "critical for energy": silicon and gallium. Silicon is the semiconductor used in 95% of solar cells, while gallium is used as a component of the semiconductors in more efficient models. Kazakhstan is currently the 10th largest producer of silicon in the world, while Ukraine was the 13th largest exporter in 2021. Ukraine is also the world’s fifth largest gallium producer.

Despite the vast mineral reserves of Central Asia, the Caucuses, and Ukraine, the regions face challenges related to geopolitical tensions, transportation, and processing. The war in Ukraine has led to a drop in mineral production overall, as valuable lithium and rare earth deposits lie trapped behind what are now Russian lines in Ukraine.

Despite the vast mineral reserves of Central Asia, the Caucuses, and Ukraine, the regions face challenges related to geopolitical tensions, transportation, and processing. The war in Ukraine has led to a drop in mineral production overall, as valuable lithium and rare earth deposits lie trapped behind what are now Russian lines in Ukraine.

For minerals from Central Asia and the Caucuses, the future is looking more promising. A reliance on Russia for westbound transport networks is being replaced by local cooperation as the middle corridor continues to garner investment and to increase capacity. However, much of the refining capacity for the region is reliant on China, making more difficult diversification away from Chinese dependence or the establishment of direct mineral-related relationships with these new supply countries. Western nations seeking to capitalize on the mineral potential of the region need to keep in mind the need for processing facilities, in addition to extraction and shipping, when choosing how to invest.

Reserves of Minerals Critical to Energy Technology

The pursuit of a greener future is intrinsically linked to the availability and management of strategic minerals essential for renewable energy technologies. As the world transitions to cleaner energy sources, the reliance on these minerals becomes increasingly vital. Central Asia, the Caucasus, and Ukraine, with their underdeveloped reserves, offer a promising alternative to the current Chinese-dominated supply chain. The regions' potential to diversify and secure the supply of essential minerals could significantly influence global energy dynamics and stability.

For Western nations, this represents both a challenge and an opportunity. By fostering investment and partnerships in these regions, Western countries can mitigate supply risks, reduce dependency on China, and ensure a more resilient and sustainable energy future. Strategic engagement in extraction, processing, and transport infrastructure will be vital to harnessing these resources effectively. This proactive approach not only supports global green energy goals but also strengthens geopolitical ties and economic stability for Central Asia, the Caucasus, and Ukraine in the face of evolving global challenges.