Russian Energy Games in Central Asia: The Caspian Pipeline Consortium Shutdown

Recent Articles

Author: Dr. Ruchan Kaya

04/13/2022

The views and opinions expressed by the author do not represent the Caspian Policy Center.

Following reported storm damage at the Novorossiysk terminal in Russia on March 23, Kazakhstan’s oil exports to the world markets have come under scrutiny. Only about 10 percent of the oil that is transported through the Caspian Pipeline Consortium (CPC) has a Russian origin while the rest is Kazakhstani oil. Kazakhstan uses the Transneft pipeline system as well, but that also utilizes the Novorossiysk terminal. In total, about 80 percent of all Kazakhstani crude exports follow this route. Therefore, the storm damage at the port created a strain for Kazakhstan and further affected global oil markets already experiencing bottlenecks.

The United States, one of the smaller buyers of this oil, is still somewhat affected. By the Energy Information Agency’s (EIA) estimates, U.S. ports received, on average, 18 thousand barrels per day of oil imports from Kazakhstan that went through the network.

Soviet Energy Transportation Legacies

Although the storm damage is the reported cause for the interruption of oil flow through Russia, it is only the latest challenge facing Eurasian oil exports. Western governments have been uneasy about the consistency of the Russian supply (or transit) of energy to the world markets, especially given the Russian invasion of Ukraine. European countries, in particular, have been concerned about their energy supply security, fearing Russia could decide to curb deliveries. Increasingly important, too, is resentment among many European governments and publics that their purchases of Russian oil and natural gas are key sources of revenue for Russia’s actions. While the Germans have triggered planning potential rationing and the EU, its member governments, and the UK and others are looking to drastically reduce imports of Russian gas, crude oil, and refined products, Russia has announced plans to force its European customers to find rubles to pay for their Russian energy imports.

However, one thing that escapes attention - despite its distinct impacts - is Russia’s role as a transit country for energy. Russia is currently creating a bottleneck for natural gas and oil supplies in world markets, not only by limiting its supply and coordinating OPEC+ to limit their own, but also by exploiting its transit status for Central Asian oil. Once the Novorossiysk terminal is shut, only Russia can decide when it becomes operational again. Pending further Russian aggression, Russia’s disproportionate effect on global energy supply security is a distinct concern for the global economy.

After the collapse of the Soviet Union, much of its energy infrastructure remained in place. These routes include the well-known Ukrainian transit corridor to the west. While dependent on the Ukrainian critical energy infrastructure, Russia has also been essential for Central Asian countries and their energy exports to the West. Therefore, despite the collapse of the USSR, post-Soviet states have largely remained dependent on each other when it comes to energy transportation networks.

Aware of these connections and Russia’s ability to choke the transit of their energy shipments, the Central Asian countries have made some efforts to diversify their energy export routes to decrease their dependence on Russia.

Turkmenistan was an early case of diversification, establishing deals and export routes with Chinese consumers. Kazakhstan has been a main partner in those projects, acting as a transit country for Turkmenistan.

|

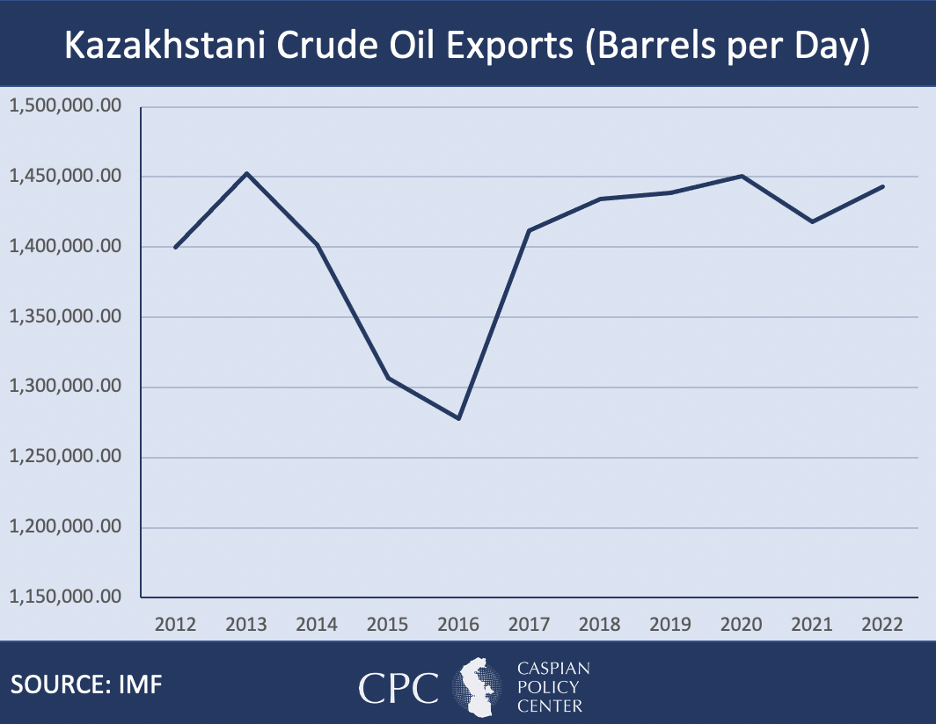

In a similar vein, Kazakhstan has been diversifying its export routes. Just like Turkmenistan’s natural gas pipeline to China, Kazakhstan has an oil pipeline that carries about 20 million metric tons of oil to Chinese customers. Currently about 20 percent of Kazakhstan’s total oil exports have been passing through non-Russian networks. This is not nearly enough for securing full Kazakhstani economic independence, as the March storm showed. In 2021, Kazakhstan exported 1.418 million barrels of oil per day; and after the storm damage, the government acknowledged that its annual oil output will fall by about 1.8 million tons. Moreover, Russian Deputy Energy Minister Pavel Sorokin estimates a decline of 1 million barrels of oil from the CPC network

Alternatives for Kazakhstan Following the Storm Damage

Despite the problems posed by the unreliable Russian oil transportation networks, Kazakhstan has alternatives for its oil production and exports. Here, it is imperative to note the distinction between transporting oil and natural gas. While transportation of natural gas is fundamentally limited to pipelines – Kazakhstan’s landlocked status rules out LNG – transportation of oil is relatively easier, including railway, sea, and pipeline transportation. On top of that, since its independence, Kazakhstan has been wise to diversify its energy export routes. China is already a large consumer of Kazakhstani crude oil, and we should expect the Kazakhstani exports eastward to increase in the coming months while Russia works on fixing the storm damage in their old oil export terminal. The future outlook could bring more Kazakhstani resources for China’s continually increasing consumption. Kazakhstan also exports minimal amounts through the Baku-Tbilisi-Ceyhan (BTC) Pipeline and there are reports that it has been talking to the Azerbaijanis about increasing use of this route; costs and the availability of tankers and barges on the Caspian may prove to be constraints, however. Regardless, the country – like others in Central Asia – needs to keep looking for further diversification of its export routes.

At the same time, now could also be the time to look at utilizing its oil domestically to produce higher value products. In efforts to resolve the problem of export interruption, Kazakhstan can ramp up crude oil consumption in its domestic industry. The country has three major oil refineries – Atyrau, Shymkent, and Pavlodar – and an option to increase its consumption of refined petroleum and by-products to ramp up fertilizer production. Kazakhstan had earlier announced its intention to increase its refining capacity from 17.1 million tons to 17.9 million tons in 2022, and recent developments could invigorate further investment into expanding refineries. These options could decrease the effect of export route bottlenecks while also encouraging Kazakhstan’s further industrialization.

Looking Ahead

It is imperative for not only EU and other European countries, but also for the states in Central Asia and the Caucasus, to diversify their oil and gas supply routes. The Russian invasion of Ukraine has been a wake-up call for various countries. Although Kazakhstan has some immediate options in place for creating alternatives to the Russian route for export, these short-term solutions are not enough. The country should focus on further diversification of oil export routes while also looking at domestic industrialization that can utilize its crude oil, add value, and increase profit margins.