Russian Relokanty: Central Asia’s New Digital Nomads

Recent Articles

Author: Dr. Marsha McGraw Olive

04/25/2024

Deportation of Tajik migrants in Russia following the concert hall terrorist attack is the latest migration surprise since the stunning exodus of hundreds of thousands of Russians after the Ukraine invasion in 2022. Both hit Russia where it hurts most: the tight labor market. Russia has too few workers. While Tajik muscle builds houses, many Russian emigrants were IT workers or entrepreneurs that powered Russia’s knowledge economy.

It is the skill set of these Russians, and where they moved, that makes this exit so shocking from an international perspective. According to a 2020 IMF report, most migrants leave a developing or emerging economy for a better life in an advanced one. Refugees generally don’t have jobs and flee conflict or war at home to find haven in a (usually) poor neighbor.

In contrast, it is rare to see highly skilled workers leave en masse from advanced to less developed economies. This is one reason why the self-designation of relokanty, or relocated people, is apt. They do not fit the classic definition of migrant or refugee. Many in the first wave in February-June 2022 objected to the Ukraine War and expected to return soon, leaving pets behind. The second wave, after the partial mobilization in September 2022, was comprised mostly of men who didn’t want to fight in Ukraine. The first port of entry was mainly Georgia and Kazakhstan, which share a border with Russia and lack visa or passport requirements.

Compared to the diverse background of 1990s Russian migrants, both waves of relokanty were comprised of highly educated urban youth, mostly male. To paraphrase sociologist Cynthia Buckley, bad politics today makes for bad demographics tomorrow. Both the battlefield loss of young men and their flight from Russia has created a ticking demographic time bomb.

What about the other side of the ledger? How will the windfall brain gain affect Central Asian economies? The answer would appear to be an unequivocal plus. The IMF found that under certain conditions, immigrants to advanced economies can increase GDP by 1 percent in five years.

Because it is so rare, it is unclear whether the same positive result will happen in Central Asia. The labor market is an obvious place to look. IT skills are in hot demand in Kazakhstan, Kyrgyzstan, and Uzbekistan, where leaders have promulgated educational and industrial policies to accelerate the application of digital technologies to government services, commerce, and transport, trade and logistics. To fill thousands of vacancies and promote IT, Kazakhstan has a massive program to increase digital literacy.

The boom in IT service exports from Kazakhstan and Uzbekistan since 2019 suggests this modernization strategy is paying off. Even double land-locked Uzbekistan can overcome borders and geographic distance by selling software design packages or call center services to global markets. I met a dynamic young entrepreneur in Almaty who was successful selling transport management software in the Gulf and Southeast Asia. She asked my advice on how to enter the U.S. market.

Yet for all this dynamism, the potential impact of the brain gain is not so straightforward. Several factors are important, including the number of relokanty and their length of stay, the domestic market for innovation (seen in new business startups), and the size of the shadow economy. To have positive long-term benefits, Central Asia needs to attract large numbers of senior IT specialists and entrepreneurs who stay long enough to open businesses and mentor junior IT specialists, while shrinking the shadow economy.

These conditions do not fully obtain in Central Asia, for several reasons. First, we are not sure exactly how many relokanty left Russia, went to Central Asia, and stayed there.

The question is sensitive in Russia because the authorities need IT talent in the military and industry and view their departure as a national security issue. The government asserts that in 2023, two-thirds came home, and that of the 100,000 IT specialists still abroad, 80% are working for Russian companies. This is unlikely because such figures downplay the fact that many IT companies voluntarily relocated, registered in new jurisdictions, and evacuated their employees. Others had to close in Russia because of international ties. Yet another group chose to stay and are thriving, with business and employees in Russia and abroad. While we do not know precisely how many returned, the salient point is that the departure of tens of thousands is harmful by exacerbating the shortage of IT specialists, seen in the 20% growth in vacancies in 2023.

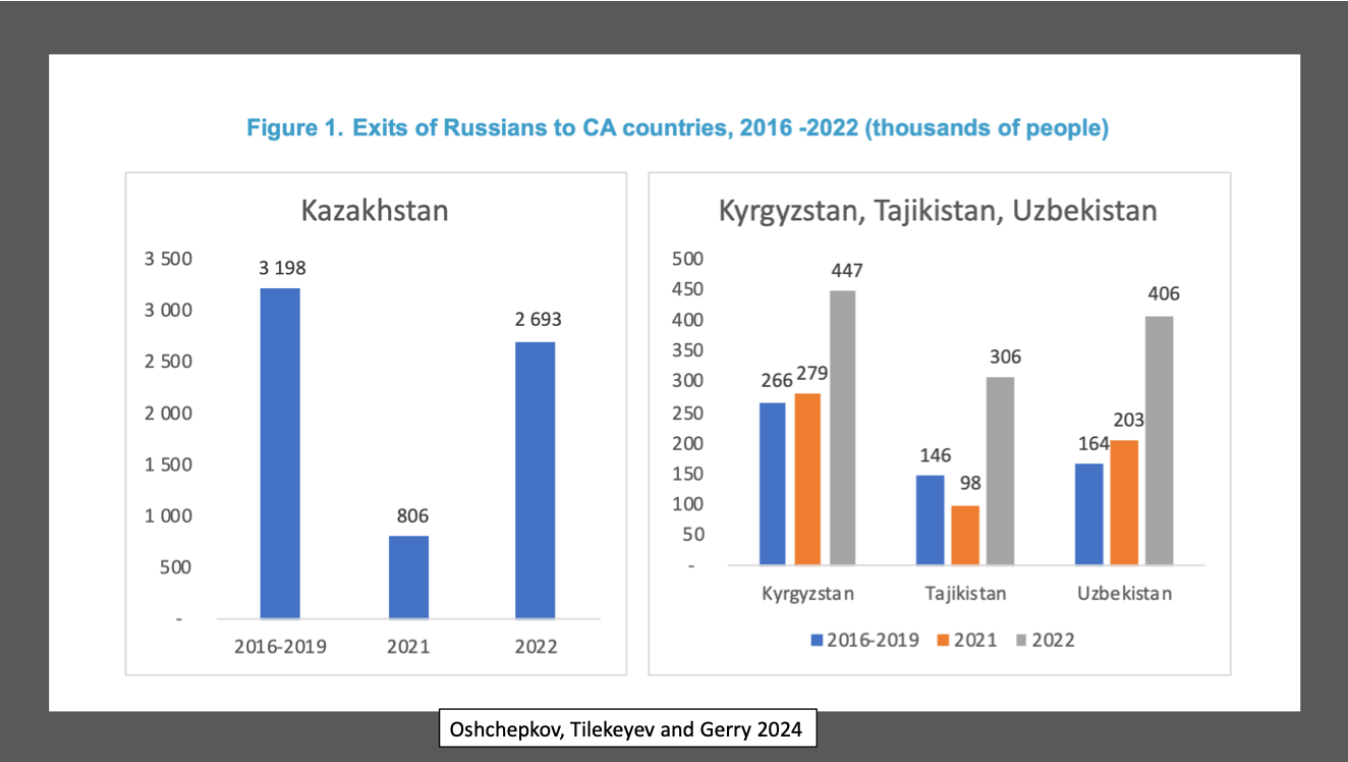

Broadly, about 750,000 to 1.5 million Russians relocated after the war began. A January 2024 policy brief by scholars at the University of Central Asia shows the number of people who exited Russia for Central Asian countries in various years (Figure 1). As members of the Eurasian Economic Union (EAEU), we would expect many people to move freely among Russia, Kazakhstan, and Kyrgyzstan for personal or business reasons (Tajikistan is not in the EAEU). But we cannot be sure how many relocated with the intention to stay. Based on open sources, the scholars crudely estimate that about 265,000 relocated to Central Asia: 65,000 to Kyrgyzstan, 75,000-100,000 to Kazakhstan, and 100,000 to Uzbekistan. Data is not sufficiently reliable to estimate relocation to Tajikistan.

But how many stayed? Again, we are unsure, but international IT experts I interviewed all share the opinion that most of the best Russian IT talent would eventually move to countries where services and opportunities meet advanced economy standards. Often Central Asia is the first of several moves, in what is known as stepwise migration. They believe a majority already left for Turkey, Israel, and Serbia. Reaching a Western country is also a goal, which is more difficult because of visa restrictions, but not impossible. For example, U.S. Customs and Border Protection data shows that 66,466 Russian citizens crossed the Southwest land border since the start of the Ukraine war. Some were transported from Turkey by coyote gangs that learned enough Russian to transport them.

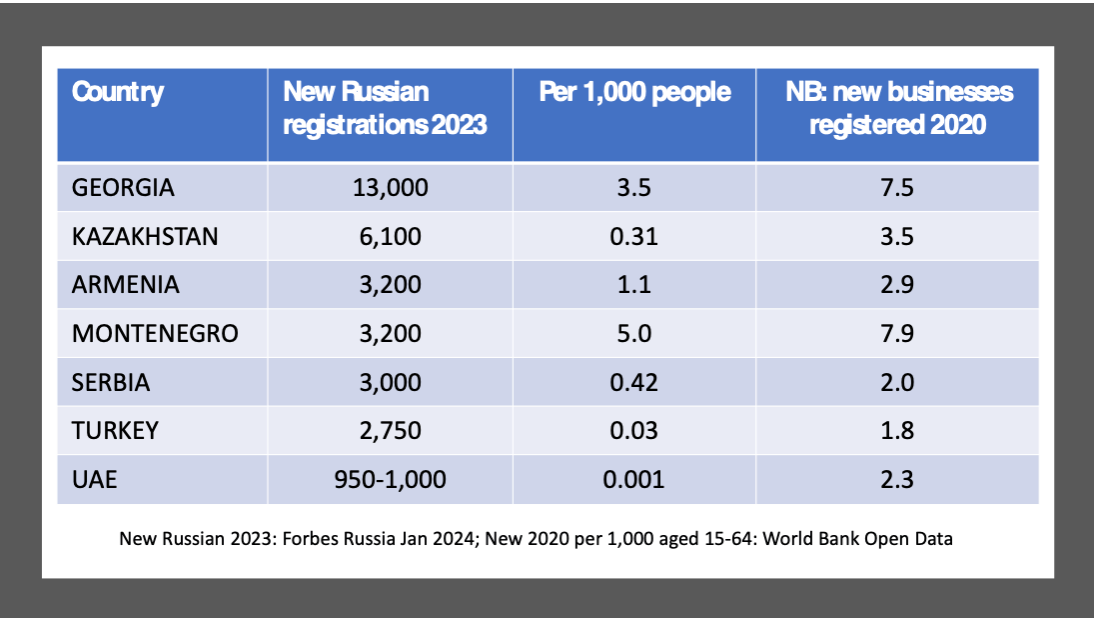

A second issue is the domestic market for innovation and business growth. Do Russian digital nomads or IT entrepreneurs that stay in Central Asia open new companies? Forbes Russia reported that Georgia wins the competition for Russian start-ups overall, where nearly 30,000 were registered since the full-scale Ukraine invasion. It remained the leader even though annual registrations in 2023 dropped to 13,000. As a share of the population, ten times as many business startups were registered by Russians in Georgia compared to Kazakhstan (Chart 1). The stronger Georgian showing relates to the number of Russian immigrants (112,000 relokanty, who tend to stay) and to the favorable environment for startups and small and medium enterprises (SMEs).

Chart 1. Business Startups by Russians in 2023 and as a Share of the Population

Finally, business growth is dampened by the large shadow economy, including informal labor, parallel trade, and illegal activities. This problem, affecting all countries in the world, predated the Ukraine invasion but became more urgent with the arrival of Russian migrants. Some work “off the books” or smuggle goods, as do many others in Central Asia. But their arrival became politically sensitive when case studies of Kazakhstan and Georgia identified Russian migrants as intermediaries in sanctions evasion. Research by Kupatadze and Marat documented how states, businesses, and individual entrepreneurs take advantage of legal loopholes to buy sanctioned goods and resell them in Russia while either failing to report or misreporting the transactions domestically and in international trade. The EAEU facilitates this process because of regulations easing cross-border movement of goods. Kyrgyzstan is also a preferred route for parallel trade because of cheaper labor, easy banking transactions, and EAEU membership.

Improving the transparency of commerce and trade is in the interests of Central Asian governments, most importantly to raise revenues, but also to avoid secondary sanctions by the United States and EU against Russia. Kazakhstan announced significant progress in reducing the shadow economy from 27% to 19% of GDP by end-2022. But its aggressive plans to reach OECD levels of 15% by 2025 will be severely challenged by the transit of sanctioned goods.

In visits to Kyrgyzstan, Kazakhstan, and Uzbekistan in 2023, EU Sanctions Envoy David O’Sullivan said he respected the position of Central Asian states that do not support the sanctions regime. But he also underscored that surprisingly massive increases in imports of European goods should not end up as re-exports that help Russia militarily in Ukraine.

Such concerns might explain the difference among Central Asian states in treatment of Russian relokanty. More welcoming states are Kyrgyzstan, which targeted Russians with IT skills through special “digital nomad” «Цифровой кочевник» status, and Uzbekistan, which offers visas for up to 3 years for foreign IT specialists. Tajikistan and Turkmenistan have largely retained status quo policies. In contrast, Kazakhstan is more restrictive, welcoming companies but reducing the visa-free period of individuals from 90 to 30 days out of 180. After that, registration is required for permanent stay.

From this analysis, it is safe to assume that the relokanty have benefited Central Asia, at least in the short term, by filling gaps in the strong growing demand for skilled IT labor. At the same time, the impact could be greater if local conditions for the IT industry, and business in general, approximated advanced economy standards. Getting to that level is critical to meet development goals, because digitalization accelerates economic growth by making all industries and government more productive and transparent.

Central Asians are making progress, with Kazakhstan, Uzbekistan, and Kyrgyzstan in the lead. They have leap-frogged from paper checks to mobile financial transactions, opened IT hubs that attract international capital, and increased tech training. Exporting IT services is the golden egg, bringing wealth and geo-economic independence through direct sales to the global market.

At the same time, more can be done to close the digital development gap with international competitors. While the rapid advance in IT export services is notable, it may be partially attributed to the Ukraine invasion, which triggered corporate relocations, and the post-pandemic recession, which led to the hiring of cheaper Central Asian IT workers. The number of businesses with Russian capital in Kazakhstan and Kyrgyzstan has doubled since the invasion and the government has a list of 400 foreign firms it is hoping will relocate to Kazakhstan. A 2023 report by StrategEast, The Billion in the Distance: Central Asian IT Exports and Strategies for Growing Them, outlines accomplishments and the path forward.

The key takeaway for Central Asia from the Russian migration saga is to maintain the momentum and, if possible, go one better to modernize the IT sector, reduce the shadow economy, and support small and medium enterprise development. Good policies will enable Tajik and other migrants to find good jobs at home. That is not a choice for Russian relokanty who fear reprisal in Putin’s repressive Russia. Russia is all the weaker for it.

This article draws on research presented on April 5, 2024 at a conference on Migrants and Exiles at the Georgetown University Walsh School of Foreign Service Center for Eurasian, Russian and East European Studies (CERES).