Barriers and Opportunities for Small and Medium-Sized Businesses in Kazakhstan Amidst the COVID-19 Pandemic

Recent Articles

Author: Aizhan Abilgazina

11/23/2020

With the COVID-19 pandemic continuing to pose significant hardships to people and businesses, small and medium-sized enterprises (SMEs) have been particularly vulnerable to the economic repercussions of containment measures and disruptions to daily business activities. Given that SMEs constitute more than 90 percent of all businesses in Kazakhstan and generate nearly 28 percent of the country’s GDP, providing adequate and timely government support is critical to ensuring that businesses can survive the current crisis and prosper in a post-pandemic environment.

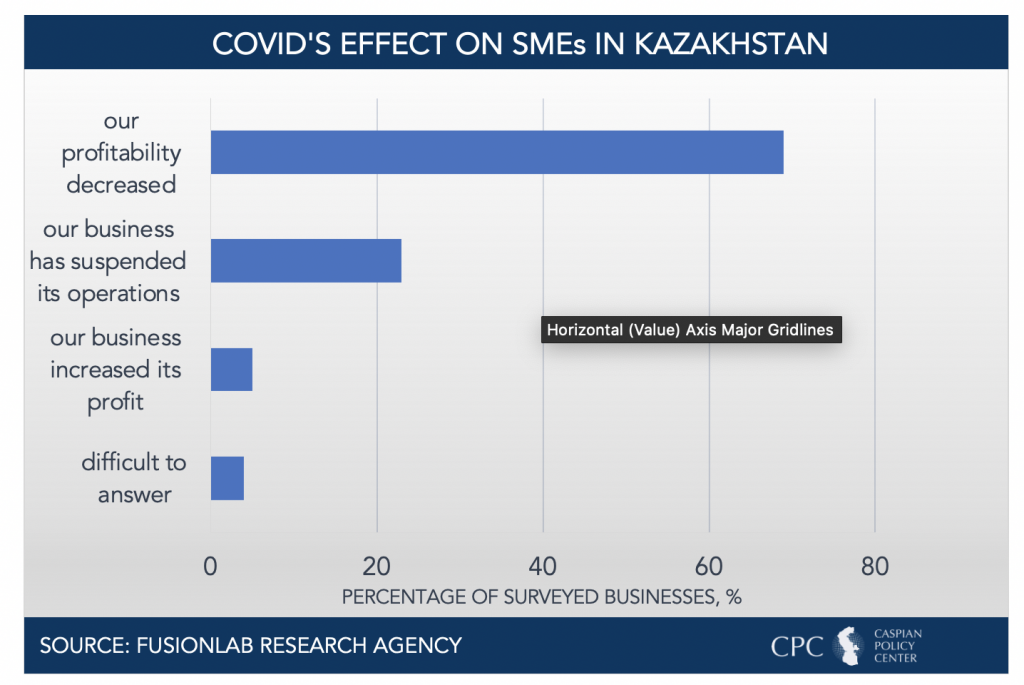

According to a study conducted by the research agency FusionLab on behalf of Visa, 69 percent of 350 surveyed businesses across Kazakhstan noted a decrease in their profitability due to the ongoing pandemic, 23 percent reported the suspension of their operations and only 5 percent increased their profits. As another report by KPMG also shows, nearly 1 million businesses in Kazakhstan have been negatively affected by the COVID-19 crisis, and more than 1.6 million people have been placed on unpaid leave.

Survey responses on the effect of COVID-19 on SMEs in Kazakhstan. Source: FusionLab

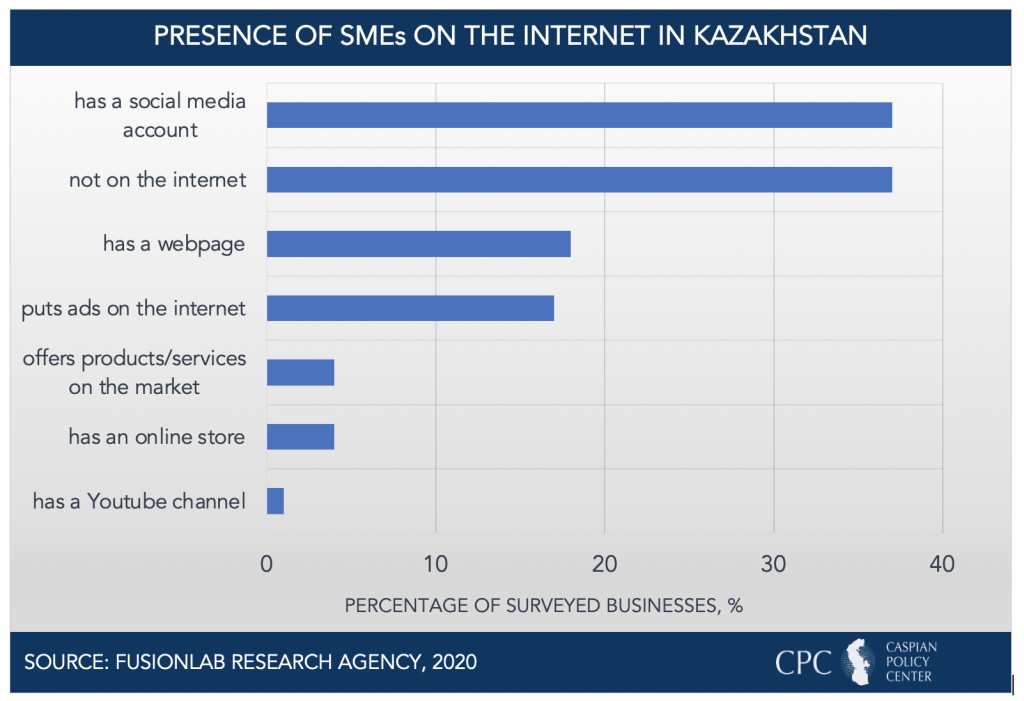

The digital divide has also become a considerable obstacle for businesses transitioning to a virtual setting. About a third of respondents in the FusionLab study noted that they are not active on the internet. Only 18 percent of those who actively use the internet to promote their products and services have a webpage and 4 percent have online stores. With the current COVID-19 pandemic accelerating the need to change existing business models in favor of digitalization and contactless operations, has become critical for SMEs to adapt accordingly. This will not only ensure uninterrupted business activities but will also significantly reduce marketing and operational costs in the long-term. Additionally, e-commerce development will also contribute to the expansion of SMEs’ customer base and open doors to new markets.

Survey responses on SMEs’ internet presence. Source: FusionLab

To help SMEs and stimulate revival, the Kazakhstani government introduced a set of policies, including the deferral of tax payments, suspension of payments of principal debt and loan fees, as well as the soft loan program with an interest rate of 8 percent for up to one year. The government has also committed to investing an additional 200 billiontenge ($476 million) in its preferential lending program that now amounts to 800 billion tenge ($1.9 billion). Additionally, president Kassym-Jomart Tokayev stressed the importance of reforming the regulatory framework for entrepreneurial activities to simplify business registration processes and make it easier for SMEs to develop their operations and expand the exports of local products and services. Since January 1, 2020, Kazakhstan also imposed a moratorium on inspections of small and micro businesses that is effective through 2023 and aimed at encouraging the growth of small enterprises. A wide range of different business organizations, including Kazakh Invest, QazTrade, Atameken, as well as the holding companies Baiterek and KazAgro also play a crucial role in supporting local businesses, attracting foreign investments, and advancing sustainable economic development in the country through lending and investment projects. Assistance to SMEs is not limited to governmental measures as international organizations also provide both technical and financial resources to further aid Kazakhstani businesses amidst the ongoing health crisis. The European Investment Bank (EIB), for example, has allocated $30 million to the KazMicroFinance (KMF) organization to help SMEs, particularly in rural areas, through soft loan programs and green lending. The project also prioritizes better access to finance, especially for women entrepreneurs.

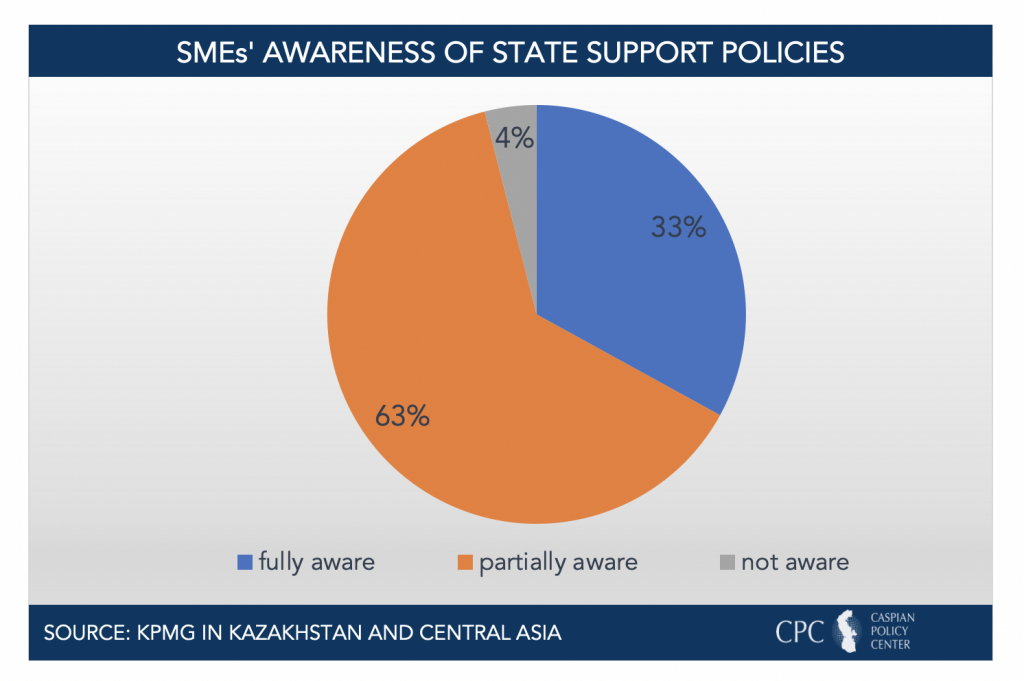

While state support measures could be an effective tool to counteract, or at least mitigate, the adverse effects of the ongoing health crisis, not all businesses are able to take advantage of them due to the lack of an effective communication platform between SMEs and the government. As the study by KPMG shows, only 33 percent of the respondents report they are fully aware of the state support policies. As some respondents also noted, the creation of a unified information portal on state support measures with a clear description of programs and its conditions would be a very helpful tool to get people more informed on the subject. They also stressed the importance of business associations in being more proactive in helping SMEs stay up to date with information on current state support projects.

Survey responses on SMEs’ awareness of state support policies. Source: KPMG in Kazakhstan and Central Asia

While digitalization has been the country’s priority even before the outbreak of the COVID-19 pandemic, the ongoing disruptions to business activities have underscored its importance and gave more incentives for SMEs to shift toward contactless operations. With more emphasis being placed on green lending, which prioritizes environmentally friendly business decisions, the current investment climate also presents good opportunities for the development of sustainable investing practices and offers good incentives for SMEs to incorporate green ideas and solutions to their business models.